Decentralized finance, or “DeFi” for short, is a growing trend in the cryptocurrency world.

DeFi protocols allow users to interact with each other without the need for a third party. This allows for more control and security when it comes to finances.

While there are many different DeFi protocols available, some of the most popular include MakerDAO, Dharma, and 0x.

Each protocol offers its own unique benefits and use cases. In this article, we’ll take a closer look at what DeFi is and how you can get started using these exciting protocols.

What Is Decentralized Finance?

Decentralized finance, or DeFi, is a financial system that runs on a decentralized network.

This could include protocols and platforms for lending, borrowing, investing, and payments.

Unlike traditional finance, which relies on central institutions like banks, DeFi is powered by code that is running on the Ethereum blockchain.

This means that it is open to anyone with an Internet connection and does not require approval from a central authority.

Because DeFi is built on Ethereum, it has access to all of Ethereum’s features, including smart contracts.

This enables DeFi applications to automate financial processes and transactions. For example, a lending platform could use a smart contract to automatically process loan repayments.

How To Get Started In DeFi?

If you’re new to DeFi, the best way to get started is to explore some of the most popular applications. Here are a few examples:

Compound: Compound is a protocol for lending and borrowing cryptocurrencies. It allows users to lend their crypto assets to earn interest, or borrow assets without having to put up collateral.

Maker: Maker is a decentralized lending platform that allows users to borrowed Dai, a stablecoin that is pegged to the US Dollar. Dai can be used to trade on decentralized exchanges or to make purchases.

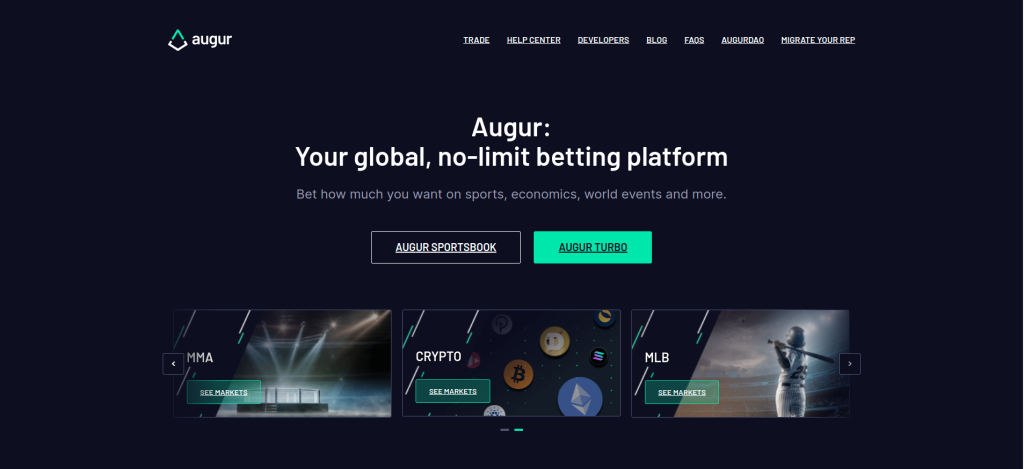

Augur: Augur is a decentralized predictions market platform. Users can buy and sell shares in the outcome of events. For example, you could buy shares that predict that the price of Bitcoin will go up in the next month.

There are many other DeFi applications available, and new ones are being created all the time. The best way to find out about new applications is to explore online communities such as Reddit and Discord.

Why DeFi Is The Future Of Finance: A Merchant’s Perspective

As a merchant, you may be wondering why you should care about DeFi. After all, aren’t traditional financial institutions good enough? The answer is that while traditional finance has its advantages, it also has several problems that DeFi aims to solve.

For one thing, traditional finance is centralized. This means that there are a few institutions that control the flow of money. These institutions can be slow to make decisions, and they often put their own interests ahead of those of their customers.

DeFi, on the other hand, is decentralized. This means that it is powered by the people who use it, rather than by a central authority. This makes it more efficient and responsive to the needs of its users.

Another problem with traditional finance is that it can be opaque. Institutions often do not disclose how they make decisions, and this lack of transparency can lead to mistrust.

DeFi, on the other hand, is transparent. Because it is based on blockchain technology, all transactions are visible to everyone on the network.

This transparency builds trust and makes it easier for users to understand what is going on. Finally, traditional finance can be insecure. Because it relies on central institutions, it is vulnerable to hacking and fraud.

DeFi, on the other hand, is much more secure. Because it is decentralized, it is not controlled by any one entity. This makes it much harder for hackers to target.

So, as you can see, DeFi has the potential to solve many of the problems that plague traditional finance. For these reasons, we believe that DeFi is the future of finance.

10 Exciting Projects That Are Changing The Face Of DeFi

1. MakerDAO

The team behind MakerDAO is working to create a decentralized autonomous organization on the Ethereum blockchain that will provide Dai, a stable coin that is pegged to the US dollar,

to users who collateralize their ETH. This innovative project is working to create a more stable and accessible form of cryptocurrency that can be used by anyone, anywhere.

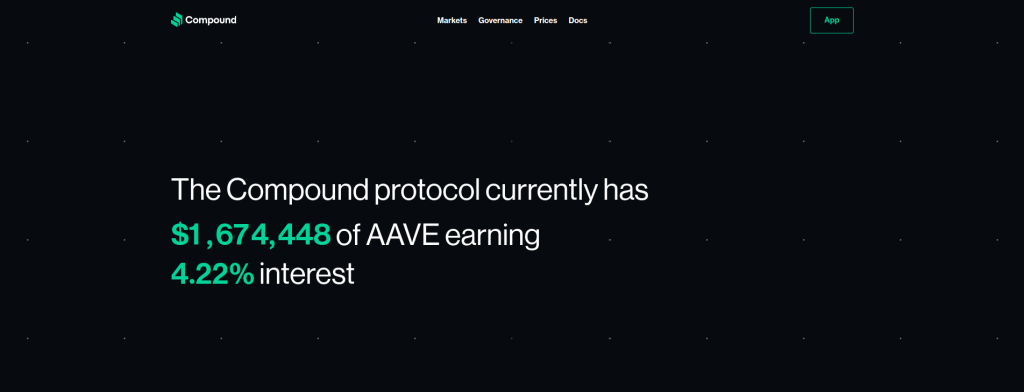

2. Compound

The compound is a protocol on the Ethereum blockchain th

at allows users to earn interest on their crypto assets.

By lending out your ETH or other ERC20 tokens, you can earn interest which is paid out in the same token that you lent. This project is making it easy for users to earn passive income on their digital assets.

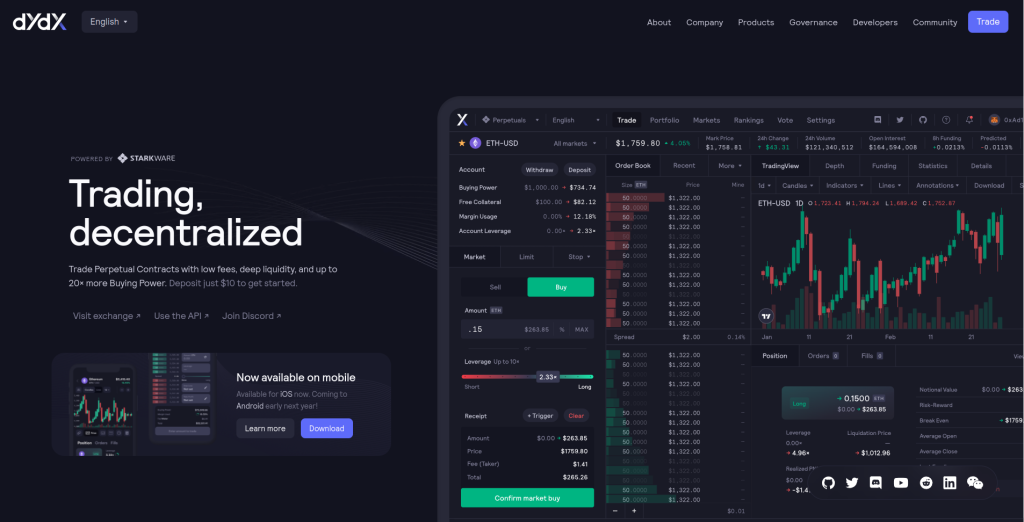

3. DyDx-

DyDx is a decentralized exchange that allows users to trade crypto assets with leverage. This platform makes it possible to trade with up to 5x leverage, which can help you amplify your gains (or losses).

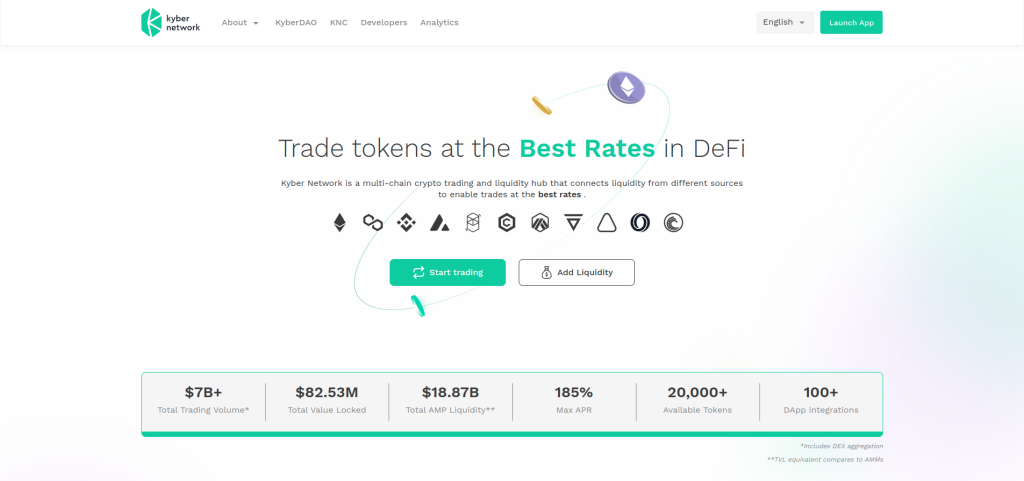

4. Kyber Network

Kyber Network is a decentralized exchange that allows users to trade a variety of different crypto assets.

This platform is unique in that it uses a reserve system to ensure that all trades are executed at the best possible rate.

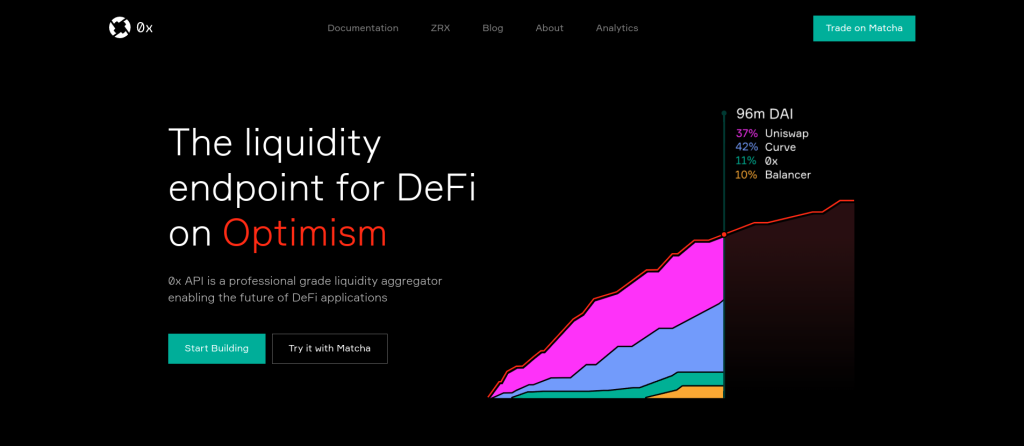

5. 0x Protocol

The 0x protocol is an open-source, decentralized exchange that allows for the trading of ERC20 tokens.

This protocol is used by a number of different exchanges and projects and is one of the most popular methods for trading Ethereum-based tokens.

6. Augur

Augur is a decentralized prediction market that allows users to place bets on the outcome of future events. This platform is powered by the Ethereum blockchain and uses smart contracts to facilitate betting.

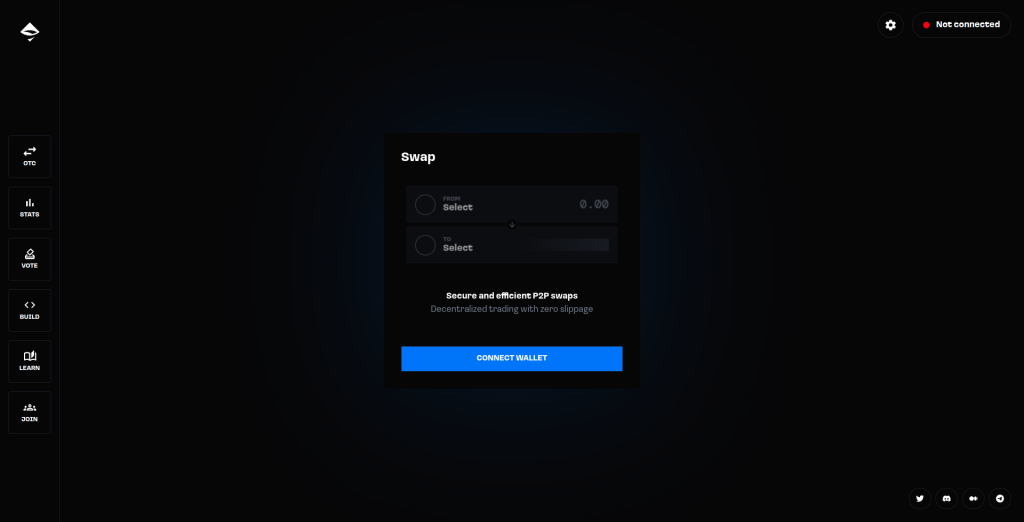

7. AirSwap

AirSwap is a decentralized exchange that allows users to trade a variety of different crypto assets. This platform utilizes the Swap protocol to provide a secure and trustless trading experience.

8. Bancor Network

The Bancor Network is a decentralized exchange that allows for the trading of a variety of different crypto assets.

This platform uses smart contracts to facilitate trading, and also allows users to convert between different tokens without the need for a centralized exchange.

9. Maker

Maker is a decentralized autonomous organization that provides Dai, a stable coin that is pegged to the US dollar, to users who collateralize their ETH.

This innovative project is working to create a more stable and accessible form of cryptocurrency that can be used by anyone, anywhere.

10. Nexus Mutual

Nexus Mutual is a decentralized insurance platform that allows users to insure themselves against hacks and scams. This platform uses smart contracts to provide a secure and trustless way to insure your crypto assets.

Quick Links

- Reasons Why Bitcoin’s Price Will Rise In The Future

- How to Invest in Stock Market in India With Small Amount of Money (100% Working)

- What Are Hardware Wallets? Best Way To Store Cryptocurrency

Conclusion – What Is Decentralized Finance (DeFi) 2025: All You Need To Know!!

In conclusion, DeFi has the potential to revolutionize finance as we know it. It has already made waves in the industry, and there is no telling what else it will be able to do in the future.

If you are interested in getting involved in DeFi or learning more about it, there are plenty of resources available online.

We hope this article has given you a good introduction to DeFi and its potential impact on the world of finance.