Cryptocurrency exchanges are platforms that allow users to buy, sell and trade cryptocurrencies.

As the digital currency market continues to grow, cryptocurrency exchanges have become increasingly popular among crypto enthusiasts looking to purchase digital assets.

Whether you’re a beginner or an experienced crypto trader, it’s important to select a reputable exchange that offers a wide selection of cryptocurrencies and features tailored to your needs.

To help you get started on your search for the best cryptocurrency exchange for your needs, this article provides some tips and advice on selecting the ideal platform for digital trading assets.

Best Cryptocurrency Exchanges To Buy Any Cryptocurrency 2025

1. CEX.io:

Users may purchase and trade digital currencies on CEX.io, which was founded in London in 2013. Users can withdraw money using bank accounts, VISA, and other debit and credit cards.

For those purchasing bitcoins, a limited number of additional payment options, such as Swift, are accessible.

A commission may be earned by those who transact in high quantities of cryptocurrency. According to the exchange, its cryptocurrency trading platform has more than 3 million registered customers.

It gives the impression of being a safe and secure crypto trading platform since it has never been hacked.

Additionally, as a client, you may safeguard your account using 2FA, anti-hacker security, and multisig account security.

Trading fee:

The 30-day trading volume of the client determines the trading cost. A taker fee of between 0.25% and 0.20% is charged to users whose trading volume is between less than or equal to 5 BTC and less than or equal to 100 BTC.

The manufacturer charge ranges from 0.12% to 0.16 percent for the same.

2. Xcoins.com:

A cryptocurrency exchange with a presence in Malta, Xcoins.com enables the trading of several cryptocurrency pairings in over 100 countries using a variety of payment options, including PayPal, Credit Card, and Wire Transfer.

The organization behind the cryptocurrency exchange was established in 2016 and is situated in the US.

The exchange was founded with the goal of making purchasing Bitcoins easy and frictionless for newcomers and those with little prior familiarity with cryptocurrencies.

The disadvantage is that using credit or debit cards for payment entails a hefty processing cost of 5%. It has a respectable daily trade volume of around 1000 BTC. It also functions as a non-custodial exchange.

Online testimonials claim that the exchange has processed more than 125 million worth of transactions for 250,000 consumers in 167 different countries.

Trading fee:

The processing cost for debit or credit cards is 5%.

3. Swapzone:

Swapzone is a cryptocurrency exchange where users may trade more than 300 currencies without ever logging in.

For individuals searching for anonymity while trading cryptocurrencies, this is a really positive thing.

This cryptocurrency exchange enables fast cryptocurrency and crypto coin trading. Users may evaluate bitcoin switching chances across exchanges thanks to its role as an aggregator of cryptocurrency exchanges.

Thanks to the utilized API, once a trader recognizes an opportunity, he or she will be able to exchange the coins inside one platform without leaving it.

Deals may be sorted by best prices for easy comparison by traders. 2020 saw its founding of it.

Trading fee:

As a crypto aggregator, you check the rates there before trading since they may vary from one crypto exchange to another.

4. Bittrex:

With over 190 cryptocurrencies listed on Bittrex, which facilitates crypto-to-crypto trading, users may swap one cryptocurrency for another.

The exchange is regarded as being extremely safe and quick in processing deals, but support is seen to be deficient.

The team behind Seattle, Washington-based Bittrex, which launched in 2014, has over 50 years of combined experience working for firms like Microsoft, Amazon, Blackberry, Qualys, and others.

The cryptocurrency exchange is one of the highest or in the top 15 exchanges, with a 24-hour trading volume of $225,425,248.

You gain from minimal costs in addition to the high degree of security and speed with which transactions are executed.

In fact, the flat rate of 0.25% on each deal is the most straightforward explanation of fees we have come across for cryptocurrency exchanges.

Trading Fee:

For all transactions, Bittrex imposes a fixed fee of 0.25%.

5. Kraken:

United States-based Kraken has been in business since 2011 and is accessible in 176 countries and 48 US states.

The 40 cryptocurrencies supported and listed on this cryptocurrency exchange include the most well-known ones, like BTC.

By daily market transactional volumes, Kraken is one of the top 10 biggest cryptocurrency exchanges.

Since it has never been compromised, unlike its rivals Coinbase and Binance, it is regarded as being very secure to trade on.

Trading Fee:

For transactional quantities of $0 to $500,000 over a 30-day period, the maker fee ranges from 0.16% to 0.10%. For transactional volumes within the same range over a 30-day period, the taker fee ranges from 0.26 to 0.20 percent.

6. Cash App:

Although it presently supports a large number of other countries, Cash App Software by Square is a highly popular iOS and Android app for sending and receiving peer-to-peer money in the United States.

Bank transfers and debit card transactions are free, however, credit card payments and fast bank deposits are subject to 3% and 1.5% fees, respectively.

It functions as a cryptocurrency exchange at the moment, enabling users to purchase and sell cryptocurrency directly from the app.

However, it only supports Bitcoin at the moment, with plans to handle other cryptocurrencies in the future.

Trading fee:

Free for bank-based sending and receiving. Credit card payments have a 3% fee, while bank quick deposits incur a 1.5% cost.

7. Coinmama:

With local, readily accessible methods and currencies, Coinmama enables you to purchase and sell cryptocurrencies.

VISA, SEPA, MasterCard, bank transfers, Apple Pay, Google Pay, and Skrill are among the available payment options.

You can only get fiat in your bank account when selling. With more than 3 million users in 188 countries, the exchange is one of the oldest in the sector.

You don’t need to deposit money when purchasing Bitcoin and other cryptocurrencies on the site; the cryptocurrency will be delivered to your external wallet within an hour.

You can monitor both current and previous orders since you must first create and validate an account before making a purchase.

Trading fees:

0% for SEPA, 0% SWIFT for orders above $1000 (else 20 GBP), 0% for Faster Payments in the UK only, and $4.99% for credit/debit cards are the payment options available.

8. ChangeNOW:

The platform for non-custodial, infinite cryptocurrency trade is called ChangeNOW. It offers the ability to convert Bitcoin for currencies like Ripple, XMR, and Ethereum.

There is no need to register an account in order to use this service. It doesn’t keep money in storage.

More than 400 coins will be available for exchange. You may swap as much as you want without any restrictions being placed on it.

With its fiat option, it allows users to purchase cryptocurrencies using MasterCard, or Visa and a third-party partner.

Trading Fee:

Transaction fees for ChangeNOW range from 0.5% to 4%, according to evaluations.

9. FixedFloat:

FixedFloat is an easy-to-use trading platform that provides resources for fully using digital assets. FixedFloat may provide a flexible, custom solution based on your needs.

There is a dedicated customer support staff for the service. The solution is well-designed and offers quick processing.

Trading Fee:

You will pay 1% plus the network cost for the fixed rate. You will pay 0.5% plus the network cost for the floating rate. No unstated commissions exist.

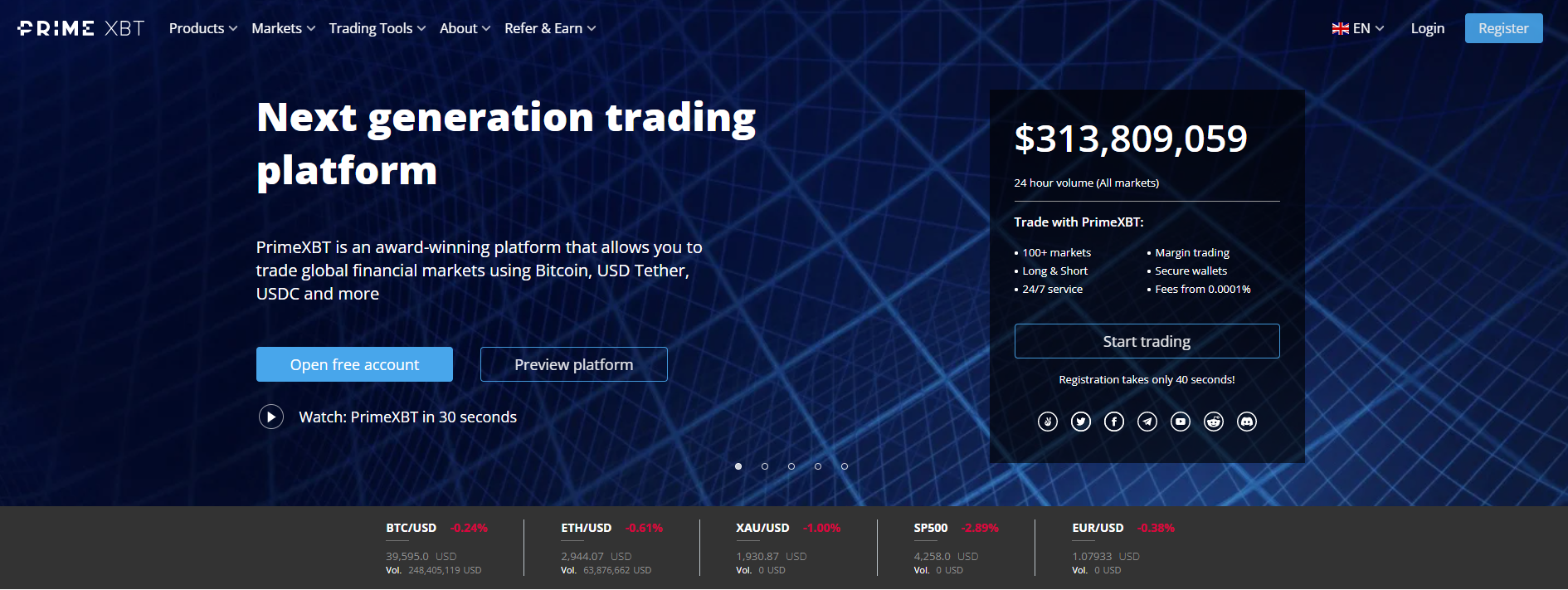

10. PrimeXBT:

The best-in-class PrimeXBT trading platform offers access to international marketplaces and round-the-clock customer service.

You may make money using this platform by introducing friends. It covers up to 50% of their trading expenses.

Converting is a more intelligent method of trading that allows you to choose from the top performers and automatically mimic their trading behavior.

You may make additional money by allowing others to track your transaction.

Using Bitcoin, USD Tether, USDC, and other cryptocurrencies on the world’s financial markets are possible using PrimeXBT.

With an account, you may trade in more than 50 markets, including commodities, stock indexes, cryptocurrencies, and a lot more.

Trading Fee:

Create a free account now. PrimeXBT provides affordable fees in addition to appealing trading conditions.

Open a Margin, Converting, or Turbo account after reviewing the trading terms. The trading cost varies by asset class: 0.05% for cryptocurrencies, 0.01% for commodities and indices, 0.001% for major currencies, etc.

11. Bybit:

Bybit is an intelligent and user-friendly bitcoin trading platform. It makes features and functions for fast cryptocurrency buying and trading possible.

It provides actual market data. It consistently maintains a 99.9% availability rate despite unpredictable market conditions. 24/7 multilingual help is offered. The values of Bybit are centered on the consumer.

Trading Fee:

It is used for trading derivatives. For all spot trading pairs, the maker fee rate is 0% and the taker fee rate is 0.1%.

12. Crypto.com:

With 10 million users, 3000 workers, and a presence in 90 countries, Crypto.com has a sizable user base.

You may use the exchange’s crypto research, analysis, and educational resources to learn to trade from the beginning or improve as an expert.

Through the use of a bank account and a Crypto.com Visa card, consumers may purchase more than 250 cryptocurrencies using money.

With the Crypto.com card, users may access, manage, and spend cryptocurrency everywhere there are Visa ATMs and merchants.

Trading Fee:

Level 1 maker and taker fees range from 0.4% ($0 – $25,000 in trading volume) to Level 9 maker and taker costs of 0.04% ($200,000,001 in trading volume) and 0.1% ($0.1%).

13. CoinSmart:

A Canadian crypto exchange is called CoinSmart. It offers assistance around the clock. It has a thorough identity verification mechanism in place that can identify fraudulent dates of birth or residences.

It uses a database that the data-gathering companies have made available. For each coin, users get cold storage.

Numerous payment options, including cryptocurrencies, wire transfers, SEPA, Interac, and all cryptocurrencies, are supported by CoinSmart.

The deposits are credited to your account the same day they are received. Requests for cash withdrawals are handled within five business days. On the same day, the account verifications are processed.

Trading Fee:

Bank Draft and Bank Wire have no fees. Charges for debit or credit cards might reach 6%. 1% transaction charge for e-funds transfers, etc.

14. NAGA:

Using manual, automatic, or copy trading bot orders, traders may trade cryptocurrencies, stocks, CFDs, and more than 90 other financial assets and products on the NAGA app and NAGA exchange.

Anyone may use the NAGA software to imitate deals made by professional traders and profit more from automated trading.

Simply look for traders’ profits over the last day, week, month, or year; choose traders, and mimic their strategies.

Users may trade cryptocurrency on the spot market using a variety of order types on the NAGAX exchange, which was established by the more than 300 individuals who work there.

It includes the well-known choices Bitcoin and Ethereum among its list of more than 50 crypto assets.

NAGAX imposes fees according on the user level, ranging from a basic level Maker and Taker cost of 00.4% to a higher level Maker and Taker price of 0.05% for the Crystal plan.

Plans are determined by the balance in NAGA coins or NCC (0-1,000 for the lowest level to 10,000+ for the maximum level).

Trading fees:

NAGA: Only 0.1 pip spreads. withdrawal costs of $5. $20 is the three-month inactivity charge. There may be a rollover, swap, and other fees. NAGAX – Free cryptocurrency deposits.

Maker and taker fees range from 0.005% (for 10,000+ NGC coins) to 0.4% (for balances of less than 1,000 NGC coins). The cost of a crypto withdrawal varies depending on the particular coin.

15. Bitstamp:

Due to its connections with more than 15 banks that have guaranteed payment rails, Bitstamp is one of the top three regulated exchanges in the Euro and USD markets (licensed to do business in both the EU and the US).

It also serves as a key fiat on/off ramp. Customers may get price information for popular Bitcoin items, round-the-clock assistance, and specialized account managers for partners via the exchange.

Last year, the exchange’s 4.6 million customers helped enable $463 billion in trade. It presently offers to trade, sending, receiving, and keeping more than 50 crypto assets.

Due to its high liquidity, it caters to a wide range of clients, including retail traders, trading companies, developers interested in offering cryptocurrencies as a service, brokers, market makers, partners, and service providers.

Pricing/Fees: Trading:

0.50% for trading volumes under $10,000 and 0.0% for trading volumes above $20 million. 15% of staking rewards are taken as stake fees. SEPA, ACH, Faster Payments, and crypto deposits are all free.

0.05% for international wire transfers and 5% for card transactions. Withdrawals are 2 GBP for Faster Payment, 3 Euros for SEPA, and 0.1% for international wire. The cost of withdrawing cryptocurrency varies.

16. Uphold:

With Uphold, you may trade more than 200 digital currencies, metals, stocks (outside of the U.S. and Europe), commodities, national currencies, and more than 50 stocks in more than 150 nations.

It also offers cryptocurrency custody and trading options for affiliates, companies, developers, and individuals.

The exchange offers fiat deposits by bank accounts and credit cards, zero deposit and withdrawal fees (apart from bank fees), minimal spreads, and inter- or cross-trading across all assets, that includes cryptocurrencies and precious metals.

Additionally, you may either put complex order types for expert traders or execute automated trades between the assets you wish to trade.

On the other side, businesses may benefit from API transactions and integrations, free custody, inexpensive currency conversions to any assets or other currencies/crypto, and the ability to receive payments or make payments in cryptocurrency. These all have security and fraud prevention features.

Trading Fees:

In the US and Europe, there is a spread between BTC and ETH between 0.8 and 1.2%; elsewhere, the spread is around 1.8%. The $3.99 withdrawal charge is applied to the bank account. API costs differ.

17. Pionex:

One of the first exchanges in the world to provide 18 free trading bots is Pionex. Users may trade automatically around the clock without constantly monitoring the marketplace.

It is one of the largest Binance brokers and combines liquidity from Huobi Global and Binance.

It facilitates manual trading by converting one cryptocurrency into another.

Its trading bot for cryptocurrencies is an automated program that executes buy and sell orders without the need for user input. When certain, pre-established market conditions are met, it executes.

Trading Fee:

0.05% for the maker and 0.05% for the taker are the transaction fees. On the website, you may see the withdrawal costs.

FAQS

🤳🏻 What is a cryptocurrency exchange?

A cryptocurrency exchange is an online platform where users can buy, sell and trade digital assets such as Bitcoin and Ethereum.

✅ How do I choose the right cryptocurrency exchange?

It’s important to consider key factors when selecting a crypto exchange, including fees, security features, customer service and selection of cryptocurrencies available. Doing research ahead of time will help ensure that you make the right decision.

🤨 Are cryptocurrency exchanges secure?

Generally, yes. Most cryptocurrency exchanges use advanced technologies and protocols to keep user data and funds safe. However, it’s important to do your own research on any exchange you plan to use before making a deposit or trading digital assets.

🤑 What fees are charged by cryptocurrency exchanges?

Fees vary from platform to platform but typically include deposit fees, withdrawal fees, transaction fees, and trading fees. It’s important to check the fee structure of any exchange you plan to use so that you know what costs you might incur when trading or transferring funds.

👍🏻 Can I make money from a cryptocurrency exchange?

Yes, traders can potentially make money from cryptocurrency exchanges by trading digital assets and taking advantage of price movements in the market. However, it’s important to understand the risks involved with trading cryptocurrencies before investing any funds.

🤔 What are the benefits of using a cryptocurrency exchange?

Crypto exchanges offer users access to a wide selection of digital assets, low fees, and fast transactions. Additionally, many platforms also provide educational resources and tools that can be used to learn more about crypto markets or track the prices of different coins. All these factors combined make them an ideal choice for those looking to trade cryptocurrencies.

Quick Links:

- KuCoin VS Binance: Which One Should I Choose?

- Bitcoin and Cryptocurrency Statistics

- Elon Musk & Dogecoin

- How To Enable DApp Browser On Trust Wallet?

- What Is Monero? Where and How to Buy Monero

- Best Crypto Paper Trading Apps & Simulators

- A Guide To How Crypto Trading Bots Work

- How to Invest in Stock Market in India With Small Amount of Money

- Tron vs Bitcoin

Conclusion: Best Cryptocurrency Exchanges To Buy Any Cryptocurrency 2025

Finding the perfect cryptocurrency exchange is not always easy due to the huge range of choices available today.

However, with some research and consideration of key factors such as fees, security, customer service and selection of cryptocurrencies available, you can find the ideal platform for your needs.

We hope that this article has been helpful in helping you select the best cryptocurrency exchange for your needs.