If you regularly read the newspaper, you might have often read about the share markets going up and down. But, you might have even spared a thought about investing in the shares. Let’s look at how you can invest in stock market in India.

Some of the factors such as the risk of bearing the loss or improper knowledge of the investment or even sometimes the less money to invest in the shares may resist you from investing in the share markets.

You should not be scared to take risks. But it is also important to act smartly when investing money in the stock market. I would spill and share with you the secrets to investment in the share market in India.

What are Stocks?

According to Forbes, “The stock market is a complex system where shares of publicly-traded companies are issued, bought and sold. To some, it is a nebulous, dark chasm where people gamble. Actually, it is not gambling at all.”

In simple words, it means that if you invest some amount of money, you win more than that and if you lose, you will only lose that amount of money.

How Do Stock Prices Rise and Fall?

A number of factors can be used to decide the rise and fall in the stock markets. They may include the opinion of the media and the well-known investors, social unrest, and natural disasters.

Photo by energepic.com from Pexels

It may also be due to the alternatives of the market. The changes in government policies can also affect the share market.

Moreover, the most important thing is the demand and supply. If there are more buyers than sellers, then the stock prices will rise ad if there are more sellers than the buyers then the stock prices may tend to fall.

Types of Stocks- Invest In Stock Market In India

Before telling you about the types of stocks, I will explain how the stocks really work if you are still not clear about them.

Let us take, for instance, the company has got 1,000 ownership in all and it wants to sell the ownership. The profits and the losses can be divided into 1,000 parts. If the company gets the profit, it can be decided by the company that if it is shared among the shareholder or to be invested in the business.

If some owner wants to sell their part of the profit, they can sell it directly to the public market as the IPO.

- Common Stocks: In this type of stock, the shareholders are entitled to the proportionate share of the company’s profit or loss. They have the right to vote the Board of Directors which can decide hat how the profits will be used.

- Preferred Stocks: Preferred stocks have a fixed amount of dividend paid to the shareholders at a predefined interval.

How To Invest In Stock Market In India With Less Money

It is always hard to decide about investing in any form of business. If the investment in the stocks is right, then it can prove to be worthy in the long term.

But before start investing in the stock, it is vital to get some important things that are necessarily required for purchasing or buying the shares. Here are some of the things that you would definitely need:

- Get a Pan Card

- Get the Broker: You can’t directly purchase or sell the shares unless there are some intermediate. These intermediate are called the brokers. They can be in the form of an online agency, individual, or company. They can take care of the whole of your investments. A number of broking companies are available online such as ICICI Direct, Kotak Securities, and ShareKhan.

- Demat and Trading Account: The Demat account or Dematerialized account can be used to hold the shares. Your Demat account is used as your identity for keeping and purchasing the stocks. You don’t need a physical asset to hold these shares. They can also be handled by your broker. Also, a trading account will be required that takes care of your stock needs such as buying and selling it. Thus, the trading account can be used to sell and buy shares.

Now, here is the quick guide to investing in the stock markets with care:

Steps To Invest In Stock Markets In India With Little Money In 2025

1. Know the Type of Investing

Before investing in the shares, you should know that what type of investments can be done in the stock markets. Usually, there are two types of investing in the market; Trading and Value Investing.

Trading is buying at lower prices and selling at higher prices when the market is high. Trading is the holding of shares for a small period of time. The maximum time frame for holding the share is a few minutes or just a few days.

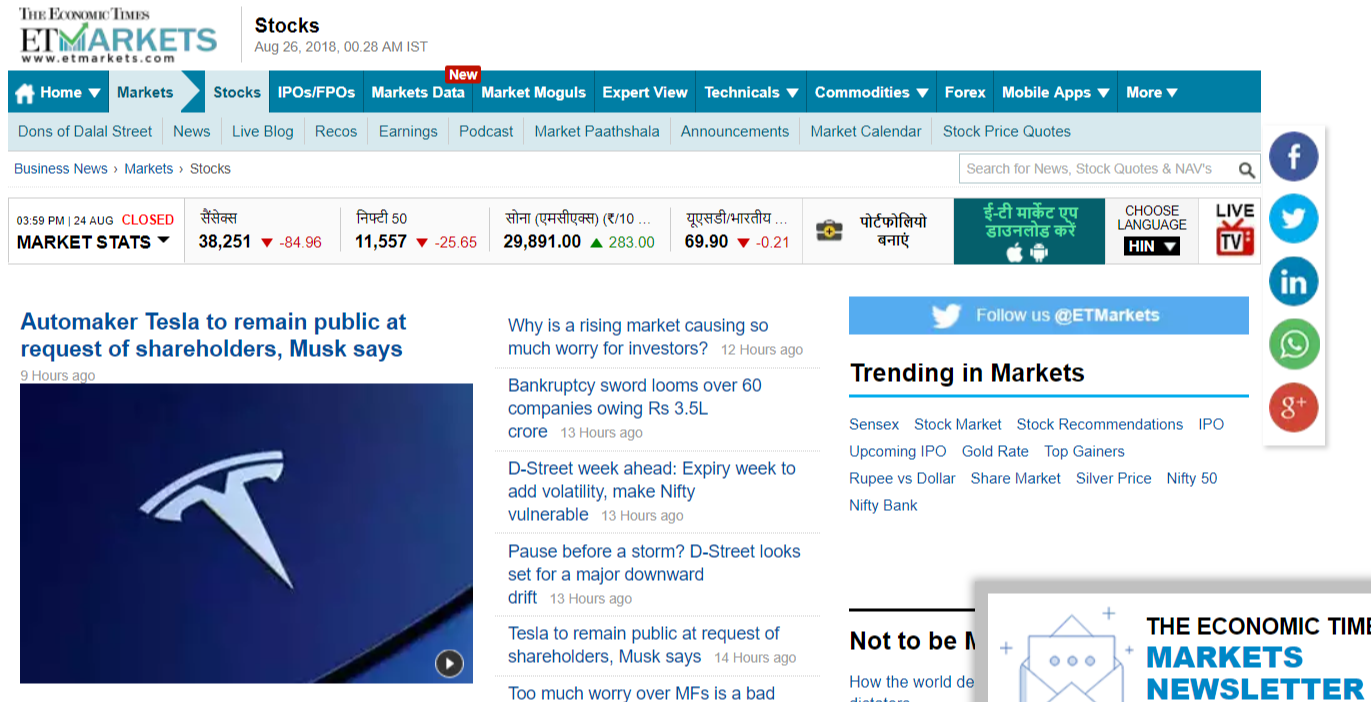

Photo by Burak Kebapci from Pexels

Value Trading as Warren Buffet suggests, “If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.”

Value investing involves the holding of shares for a longer period of time. Value investing is mostly preferred by people who wish to invest for a longer period of time. The advantage of value investing over trading is that the investors get to hold and get the advantage of dividends and the stock splits.

2. Know Your Goals

It is really important to pre-define your investment before investing in the stock market. Setting goals is important in every aspect of a business. Thus if you are thinking of investing your savings, then know what is your goal to invest?

Image Credit: Pixabay

If you have thought of buying a vehicle or something that you would need right now, then you can invest it for a shorter period of time. And if you are thinking of purchasing a house with your profit, then you can invest it for a longer period of time.

Also, I would recommend reading some useful books and gathering information about the stock and share markets before getting into it.

Some of the books that should definitely be read are:

- The Intelligent Investor: by Benjamin Graham

- One up on wall street: by Peter Lynch

- Common stocks and uncommon profits: by Philip Fisher

3. Filter the right stocks

There are a number of stocks available on NSE and BSE and you can’t merely decide the future of the stocks. You can indeed find ways that can help you to filter the stocks well and invest in the right one.

Several screening criteria may be used that can help you get the best right stock to invest.

- Market Cap> 500 Cr

- Sales and Profit Growth > 10%

- Debt to Equity Ratio < 1

- Price to Book Value <= 1.5

- Price to earnings value < 25

- Current Ratio > 1

To get this data, you can look into the sites that deal with the stock markets. You can look for the sites such as Moneycontrol and Equitymaster to look over these data and sort the best stock that fits your needs.

The Equitymaster has its free stock screener tool that can be used to filter the stock in terms of the above parameters.

4. Understand the Company

After you have filtered the companies and have got the result, your next step should be to track each and every company.

Know what the company gives you. You can look at the sorted table and decide which of the following share is perfect for you to invest in. Let’s assume if you are from the IT sector and the company with an IT background will be easy for you to understand.

Not all the company will show the same amount of growth percentage, you should understand the table well and know about the background as well as the history of the company.

Invest in the Business that you understand. Do not understand the company, understand the stock.

5. Find Low Debt Levels

Look for a company with low debt levels. Never go for the company that has borrowed a large sum of money from the market and is considered unable to pay the debt. Look for the company that has got low Debt to Equity Ratio and a low Current ratio.

The company that has reduces its debt will surely be increasing the profits. A much better way to keep a check on these companies is by choosing the company’s balance sheet.

The balance sheet has the long-term viability and the current liabilities listed in the balance sheet. The company which will have more debt will find it hard to pay the debt and thus there is less chance of profit too.

6. Never Invest more than 10% in a single Stock

I would also say here not to invest more than 10% in a single share. Also, these shares must not be invested in one go. Take your step slowly and steadily.

Also, keep away from the stocks that give less than 50% delivery. More speculators in a single stock may increase the volatility of the stock and thus lower volatility would usually mean a higher increase in the stock price.

What I also mean here is that do not ever invest the whole of your shares in a single type of industry. Let us take an example if you invest a part of your investment in the Tech Mahindra and the other part in Maruti. What If there is a recession in the whole of the automobile industry?

It’s important to diversify your portfolio while doing any investment.

7. Select the platform and track your performance

It is also important that you keep track of the stocks that you are going to buy and track the performance of your shares by using various mobile apps and financial websites.

If you do not want to keep the mobile apps or financial websites, you can simply look for the various excel sheets.

In the excel sheet, create the three tabs that are enough to tell you about the stocks:

- The stocks that you need to study and investigate

- The stocks that you have already studied and have found it decent.

- Miscellaneous stocks that you want to track for the others stocks too.

While you can track your activities using the excel sheet, I would recommend a few mobile apps that can track the performance of your stocks.

- MoneyControl

- Economic Times Market

- Yahoo Finance

- Investar

- Stock Watch

- Stock Edge

- Market Mojo

- Trade Brains

8. Honest and Competent Management

As a newbie, you must not be verily aware of the market risks and thus one of the risks also includes Fraud management. Fraud management is one of the main reasons people are still reluctant to invest and baffle about where to invest.

This fraud by the companies can cause huge loss to the investors by the accounting frauds or by means of misled shareholders & SEBI.

You can check out the transparency and competent management of the company by considering the following facts in mind:

- Look for the Fraud on the internet: To check for the frauds and their past records against any default, you can refer to the Google and find out if the company has relevant track records or if there are any fraudulent records against them. Look for the records against the CEO/CMOS and the executives of the company.

- Read Annual Reports: It is important to read out the annual report of the company which you can get on the company’s website. This would make you familiar with the management analysis, strategy, and future vision of the company.

- Look for the shareholding: The promoters’ shareholding in the company is a positive signal for the company’s growth. Thus, the higher stake in the company by the promoter would certainly mean that the trust in the company is massive.

9. Select the Right Price

Choosing the right price is the most important aspect here. It would be mere foolishness if you have looked for the stocks without even filtering it well.

Do not buy the stock at a steep price. Purchasing the stock at a steep price would surely pose the risk of an uncertain future and thus the loss.

Look for the intrinsic value or the actual worth of the stock before buying it. What I mean here is that look for the stocks that are available at the discounted price after the narrowed search.

You can calculate the intrinsic value of the stock by using a virtual calculator called Discounted Cash Flow Model.

10. Monitor your portfolio

The market is not constant and it might rise or fall anytime according to the various factors that I had listed above. Therefore, as a smart investor, you should look for the investment portfolio periodically can keep a thorough check on it.

Plan your exit and entry well according to the performance and the future of the company. Research for a company where traders have an interest for a longer period of time.

Quick Links:

- What Is Residual Income, And Why Should You Have It? (And How To Get It)

- {Updated 2025} Best Trusted Websites to Make Money Online from Home

- {2025} How To Start Vlogging And Make Money In 8 Easy Steps: Quick Guide

- Instamojo.com Review-Collect Credit Card and Net-Banking Payments Online in India

- Mindvalley Quest Review

- Seller Snap Review

The Final Words: Invest In Stock Market In India 2025

Investing in a stock is hard to decide and can’t be merely done with just money. You need to explore, read, research, and all of the above to get the best consultants before investing in the market.

Thus, it doesn’t involve a thing or two. Consider various factors in mind before investing in the market. Make sure that you have created a concentrated portfolio and each of the different industries.

Do not try to rush and wait for the right time to flush out your money. Look for the goals and hold for the right time.

. I have listed the best rules on How to invest in stock markets in India with less money.

If you have more rules that you think I have missed here, you can suggest me in the comment box.