In this post we are going to discuss about Vijay Mallya net worth and 3 life lessons to learn from him.

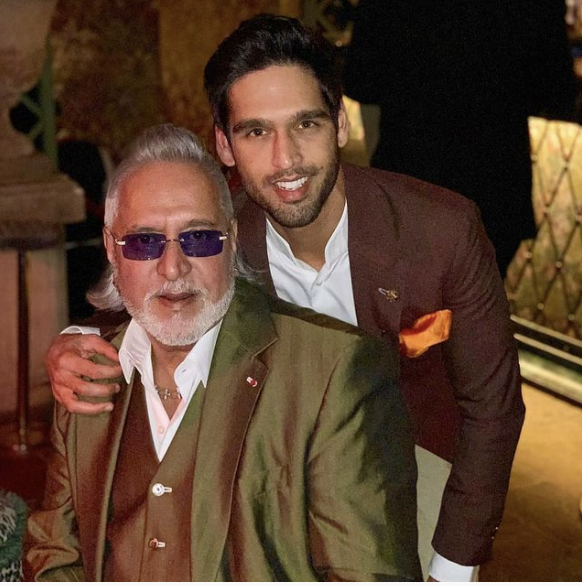

Vijay Mallya is an Indian business tycoon.

Former member of Parliament Mallya. A motion to extradite him from the UK to India has been filed by the Indian government. In the past, he owned the Royal Challengers Bangalore cricket team.

According to estimates, Vijay Mallya’s net worth will reach $1.2 billion by 2021.

Vijay Mallya Net Worth 2025: Career

Mallya assumed the chairmanship of United Breweries Group after the death of his father in 1983. More than 60 companies are part of the group today. UB Group is the consolidated name for the group.

His success and fame continued throughout the 80s and 90s. Within a few years, he became one of India’s top businessmen.

Kingfisher , India’s best beer, is included in United. With 100 million cases sold, United Spirits is the second-largest spirits company in the world.

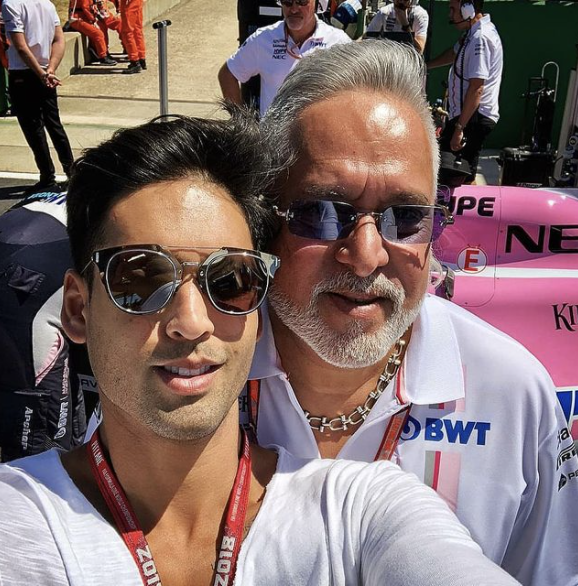

The Spyker Formula One racing team was purchased by him in 2007. Name changes included Force India F1 and Sahara Force India. The Independent MP has a political career.

The company’s management control was ceded to him in 2012. He currently serves as United National Breweries’ chairman. As well as alcohol, the group of companies is focused on life sciences, agriculture, chemicals, engineering, aviation, and information technology.

Mallya had to resign from United Spirits after receiving a cheque for $75 million. An Indian court blocked the payment.

According to estimates, Vijay Mallya’s net worth will reach $1.2 billion by 2021.

The missteps of once high-profile liquor baron Vijay Mallya are instructive in regards to personal finance, even as Kingfisher Airlines becomes his undoing.

Vijay Mallya Net Worth 2025: Learnings From His Mistakes

Here are few things to learn from his mistakes.

1. Don’t let emotions dictate investments:

Before launching Kingfisher Airlines, Mallya led a successful business group. No previous experience was available to him, and aviation is known to be a challenging industry. Nevertheless, Mallya jumped in.

Vanity has cost Kingfisher’s lenders and shareholders dearly.

Especially real estate, new-fangled derivatives, and other exotic financial products should not be lured by their apparent attractiveness. Derivatives are hedging instruments, not speculation instruments.

Investing in futures is extremely risky and Warren Buffett described it as a weapon of mass wealth destruction.

PPFs, fixed deposits, and mutual funds are good investments for the average investor. Kingfisher-like crashes often result from flights of fantasy.

2. Overconfidence ruins:

Mallya’s fall from grace was largely due to his hubris. Mallya believed Kingfisher Airlines would also succeed because he had succeeded in other businesses.

If small investors make money from the selection of some stocks, they shouldn’t fall for the overconfidence bias. Investors with overconfidence invest directly in stocks, rather than hiring a mutual fund manager for a small fee.

How did your past investments do? Were they simply luck or were they based on informed choices, tips, or pure coincidence? Experts are always the best choice.

3. Don’t live on debt:

Mallya spent lavishly even as Kingfisher Airlines struggled to make money. Kingfisher Airlines relied heavily on bank loans to survive. Kingfisher’s losses were overlooked by banks as well. Excessive leverage was the downfall of Mallya.

A clutch of banks have lent over Rs 9,000 crore to Kingfisher, which has accumulated losses of Rs 4,301 crore.

Investing in debt that investors can’t service is a bad idea. Over 50% of your net take home pay should be allocated to EMIs and credit card bills.

4. Review performance and change course:

Despite all the warnings, Mallya continued to pour millions of dollars into Kingfisher Airlines. In denial, Mallya carried on.

It is imperative that investors review their portfolios at regular intervals and take corrective action if needed. You need to rejig your portfolio if a fund’s performance has dipped or if a stock has received bad news.

You will see healthier returns if you identify and eliminate under-performers as early as possible.

5. Don’t give in to herd mentality:

Kingfisher cannot escape the blame even though Mallya is guilty of financial misdeeds. The new reports suggest that they did not do due diligence before lending to the troubled airline and followed a herd mentality.

It is possible to lose a lot of money due to confirmation bias. If a broker or analyst has recommended a stock or investment, don’t read only the reports that confirm their recommendation. Read the criticism as well.

Vijay Mallya Net Worth 2025: 3 Awesome Lessons to Learn

Let’s take a look at some of the lessons we can learn from Vijay Mallya now that you know all about his net worth and how he achieved success:

1. Work hard

Besides working hard, Mallya plays hard as well. This is nothing to be condemned.

2. Live the Life You Want To Live

Vijay lives his own life without commenting on the lives of others.

3. Challenges

To move on from a challenge, one must not be scared of it.

Quick Links:

Conclusion: Vijay Mallya Net Worth 2025

Vijay Mallya is an Indian entrepreneur and politician. His hometown is Kolkata.

St. Xavier’s College, Calcutta, was his college of choice. In the United States, he interned with Hoechst AG after graduating from university. Mallya is known for his extravagant lifestyle and is known as the “King of Good Times.”

Mallya is chairman of the United Breweries Group.

According to estimates, Vijay Mallya’s net worth will reach $1.2 billion by 2021.